Like school children across the UK, political leaders are about to embark on an extended summer break. But unlike their younger counterparts, the sense of end-of-term jubilation is (rightly) absent. The government has achieved far less than it set out to do – and is now looking ahead to the next instalment of the political year with trepidation. If it were to be given an end of year report it would probably be peppered with comments such as “must do better”, “lacks attention to detail”, “easily distracted”, “prone to falling in with the wrong crowd” “fails to deliver” and “unconvincing performance”.

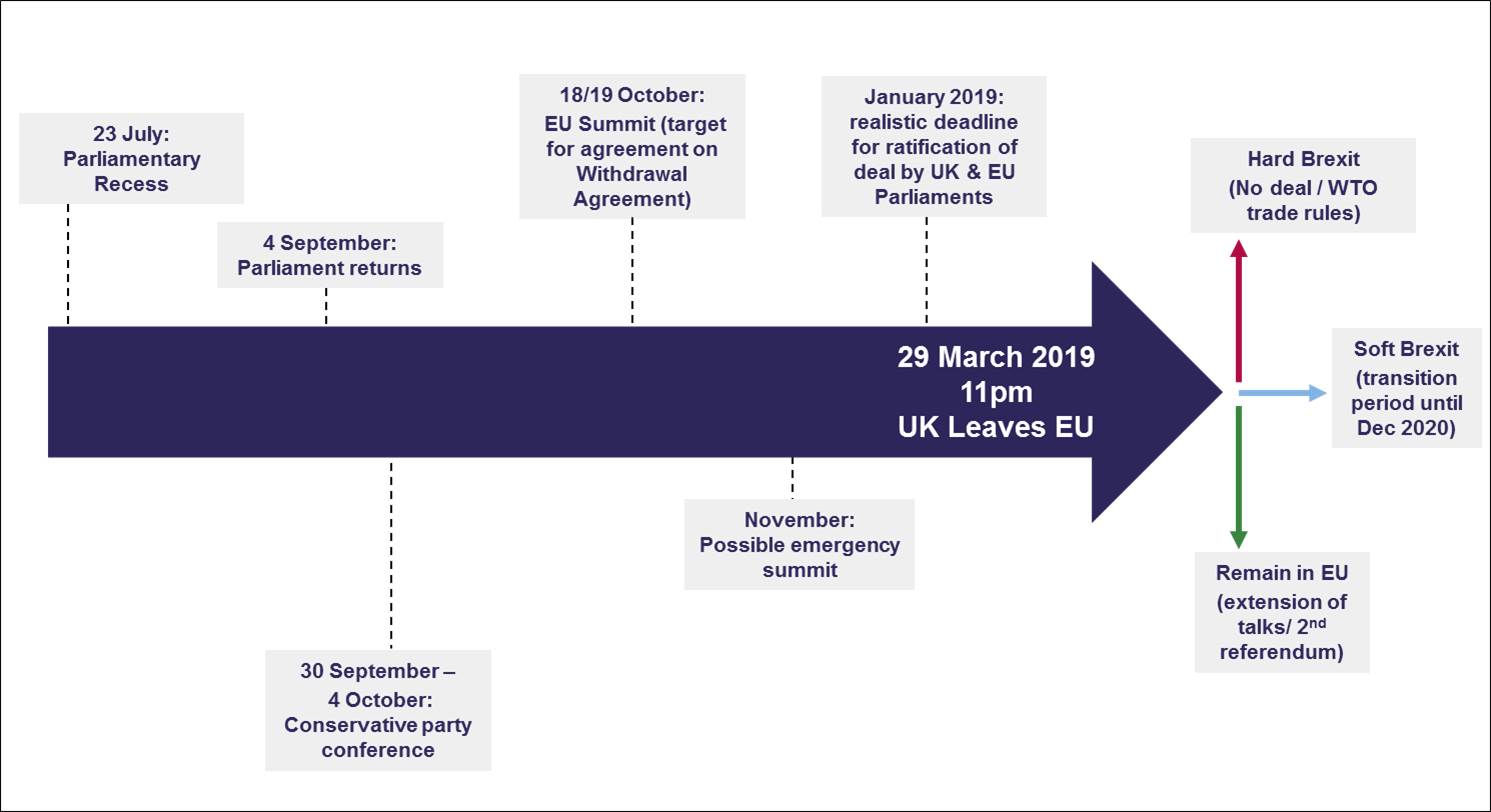

So where does this leave the Brexit process? As set out in the attached timeline, there will be less than seven months until the UK is set to leave the EU when MPs return from their summer break. And it’s unlikely that they’ll return with cooler heads and harmonious intentions. Meanwhile, there’ll be more drama in Brussels – and a scurry to prepare for the realities of next year, whatever the deal.

Parliament: Conservative playground battles to escalate

She was apparently an upbeat presence at the usual end-of-term drinks parties but May has barely scraped through the past year with her leadership intact. And achieving that has been at the cost of granting significant concessions to her hard-Brexit colleagues, in the form of four amendments to a taxation bill in Parliament. Despite her claim otherwise, these changes alter her preferred bespoke customs arrangement in a way that will make the White Paper proposal for the future relationship even less palatable to the EU. Most significantly, it now looks for reciprocal tariff collection at borders by the EU, something that the EU will never agree to. She may have appeased the pro-Leave camp for now – but her (aborted) attempt to call an early start to the summer break demonstrates her nerves about a leadership threat. The Brexiteers may enter the recess dominating the debate but with the EU now even more likely to resist May’s proposals and respond with demands of their own, they will get restless again. Her new Brexit Secretary, Dominic Raab, has admitted that some of the Cabinet are still to be “persuaded” of the merits of the White Paper proposals.

Indeed, the failure of the pro-Remain camp to make its mark on the Brexit-related bills means May is presiding over an increasingly splintered party. An outcry about the dirty tricks employed to keep rebel Remain MPs in line (from explicit threats of precipitating a General Election to reneging on an agreement that wouldn’t disadvantage an opposition MP on maternity leave who wasn’t able to vote) has set the tone for heightened volatility to remain once Parliament reconvenes in September. Meanwhile, May faces demands from the Northern Irish DUP, the party whom her minority government relies on for its Parliamentary majority. The threat of a leadership challenge to May ahead of the Conservative Party conference at the end of September remains significant.

Brussels: in no mood to make amends

While bitter infighting was playing out in the corridors of Westminster, EU officials were browsing the long-awaited White Paper. The noises are as discouraging as they are unsurprising. The Commission’s guidelines already stipulate that “the four freedoms of the single market - free movement of goods, capital, services, and labour - are indivisible and that there can be no “cherry picking’”. Accordingly May’s plan for a free trade area in goods with a common rulebook yet no freedom of movement of people – was met with disdain when presented by her chief Brexit adviser Ollie Robbins. Brussels do not see the White Paper as a basis for negotiations, let alone a “take it or leave it” offer that May and the Brexiteers hope, instead stressing the need to look for “common ground”. Negotiating the future relationship will clearly be a protracted affair, and yet one in which May would seem to have no room for compromise given her Brexiteer would-be assassins.

But the White Paper is for now, background white noise. For all the attention, whether or not the UK crashes out of the EU on the 29th March without a deal does not depend on detail of the future relationship. There only needs to be the vaguest broad agreement on that (and it won’t be legally binding). What will be key is full agreement on the terms of withdrawing. The EU’s chief negotiator Michel Barnier has previously said that about “80%” of that detail has been agreed. The main stumbling block remains the border between Northern Ireland and the Republic and specifically, the “backstop”, fallback arrangement which will continue, in the interim, to ensure no hard land border between the two. Both sides recognise the importance, but achieving it will mean compromise. One suggestion would be a fudge, whereby, say, the UK remains in the customs union but only Northern Ireland remains within the single market. That would need a concession from Brussels but would mean an arrangement onerous enough to be unappealing to the UK long-term, incentivising a longer term deal. Barnier has indicated that he’d be willing to amend the EU’s current proposal and the UK will be hoping that its White Paper signals that any backstop will indeed be temporary. But the talks are complicated by the DUP’s demands for a legal assurance that Northern Ireland will not face different treatment to the rest of the UK and that the border would not, in effect be in the Irish Sea. Squaring this circle looks impossible.

Dominic Raab has suggested that talks continue over the customary August break. That, like the tour of the EU being currently undertaken by his fellow UK ministers ,may be largely showmanship. But it comes as both sides have ramped up the warnings of a possibility of no deal scenario – and that is more than just a negotiating tactic. The potential cost to both sides of such a scenario is steep: the IMF warns that a hard Brexit would cost the EU itself 1.5% of growth by 2030, as well as taking 4% off UK (and Irish) growth.

Even cancelling summer holidays would mean just thirteen weeks of talking time ahead of the EU Council meeting in October at which agreement really has to be reached to allow the time for ratification, notably by the European Parliament to ratify. But given the red lines on both sides, agreement by then, or even November (when an emergency summit could be held) looks challenging.

The outlook has become increasingly uncertain. There are, broadly, three possible situations the UK could find itself in on 30th March: falling off a “cliff edge” into a hard Brexit (with either no deal, or with WTO rules for trade and other deals arranged to try to avoid disruption elsewhere – as outlined below for aviation), a transition period leading up to a soft Brexit (with an eventual deal at the end of the transition period, or later, based either on a version of the White Paper or EEA terms) - or remaining in the EU (due to being granted an extension of the negotiating period or a second referendum). The research team at Daiwa currently estimate a roughly equal probability to each of those three.

Behind the scenes: preparing for testing times ahead

On the grounds that nothing is agreed until everything is agreed, preparations for a “no deal” are intensifying on both sides of the Channel. The European Commission makes it clear that in its brief but succinct guidelines on preparation that any type of exit will “undoubtedly cause disruption”. As has typified this process, the UK has been slower off the mark but will be publishing 70 advisory technical notices to businesses and consumers over coming weeks. In the meantime, many companies have unilaterally implemented contingencies to circumvent upheaval, and talks are going on behind the scenes between agencies to minimise disruption. In a series of reports on areas from consumer protection to transport, the government watchdog, the NAO has concluded that while preparations are largely underway, they are behind schedule in many cases, and getting the necessary structures in place may be “challenging”. Dominic Raab only heightened concerns with a failure to deny reports that the government is planning to stockpile food to mitigate the impact of a hard exit.

A warning by the Irish Premier, Leo Varadker of the potential impact to flights originating in the UK underlines the complexities and confusion surrounding this uncharted course. Of course, neither country would want flights between Dublin and London to cease. However, enabling any British planes to continue to be able to fly in a “no-deal” Brexit will require a new legal framework. And there remain question marks about the ways in which the rights of three million EU citizens living in the UK will be administered. Even in the event of a White Paper deal, bosses from the UK’s tax office warned that the infrastructure required for May’s customs arrangement may not be in place by the end of the transition period – and would cost business an additional £700m per year.

Meanwhile, only two of the Bills needed to provide the legal underpinning to Brexit have been passed by Parliament. Fortunately, they include the Withdrawal Bill, the only one that needs to be completed ahead of the transition period. However, the rest, including the recently debated customs bill, are behind schedule (a few – including the migration bill - have yet to enter the process) – and if there is no deal and no transition period, the need to complete these is even more pressing. Parliament is only in session for about 50 days ahead of Christmas.

The clock is ticking, and it is highly debatable how much progress will be made with the withdrawal deal over the summer, and how palatable any outcome will be. Brussels is likely to continue resisting any bespoke plan which sets a new precedent – while the pro-Brexit lobby may be keeping their fingers crossed for no-deal. Whatever happens, May is likely to come back to a more fractious Parliament. She’ll face an ever more frantic rush to get a deal signed off, with her job intact, and in time for a vote ahead of March 2019 – or risk legal and economic chaos. If she’s to make the grade, it’s time, now more than ever, to put country ahead of her party.

Brexit: The path to March 2019